Apply For GST Registration

GST registration not only helps you in getting your business recognized as a legal registrant but also opens a number of opportunities for your business. Benefits to GST registered business at glance are as follows: -

- Become more competitive – You will be more competitive in comparison to your unregistered competitors since you will carry valid tax registration.

- Expand your business Online – You cannot sell products or services on e-commerce platform without GST registration. If you're planning to give a blow on e-commerce platform like Flipkart, Amazon, Paytm, Shopify or through your own website, you must need a GSTIN.

- Can take input tax credit – Only Registered GST holders can avail input of GST tax paid on their purchases and save the cost.

- Can sell all over India without any restrictions – Without having GSTIN you cannot trade inter-state. This is possible only if you registered your business under GST.

- Apply Government Tenders – Various government tenders requires GSTIN to apply tender.

- Open Current Bank Account – Especially, in case of sole proprietor business Banks & Financial Institution does not open a current bank account in the name of business trade name unless you carry any government proof in the name of your business.

- Registration of any business entity under the GST Law implies obtaining a unique number from the concerned tax authorities for the purpose of collecting tax on behalf of the government and to avail Input Tax Credit (ITC) for the taxes paid on his inward supplies.

- Without registration, a person can neither collect tax from his customers nor claim any credit of tax paid by him.

- Entities with turnover exceeds of Rs.40 lakhs (supply of goods in normal state), Rs.20 lakhs (supply of goods/services in normal state), Rs.20 lakhs (supply of goods in specific state) or Rs. 10 Lakhs (Supply of goods/services specific state) and above would be required to register under GST.

- The eligible entities must file GST application within 30 days from the date on which the entity became liable for registration under GST law.

Documents required for Goods and Services Tax Registration (GST)/GSTN:

FOR COMPANY

- Director’s PAN CARD- All Directors

- Director’s Aadhar Card

- Soft copy of Photograph

- Board Resolution for Authorising any Director

- PAN Card of Company

- List of Sale & Purchase Items

- Cancel Cheque

- Certificate of Incorporation

- Rent Agreement

- Address Proof of Shop/Branch/Godown/Store: Anyone of the following (Should not be older than 2 months)

- Electricity bill

- Water tax

- Municipal Tax/House Tax Bill

Digital Signature Certificate (DSC) of at least one director

FOR PARTNERSHIP/LLP FIRM

- Partners’s PAN CARD- All Partners

- Partners’s Aadhar Card

- Soft copy of Photograph

- Resolution for Authorising any Partner

- PAN Card of Company

- List of Sale & Purchase Items

- Cancel Cheque

- Partnership Deed/ COI of LLP

- Rent Agreement

- Address Proof of Shop/Branch/Godown/Store: Anyone of the following (Should not be older than 2 months)

- Electricity bill

- Water tax

- Municipal Tax/House Tax BillDigital Signature Certificate (DSC) of at least one partner in case of LLP.

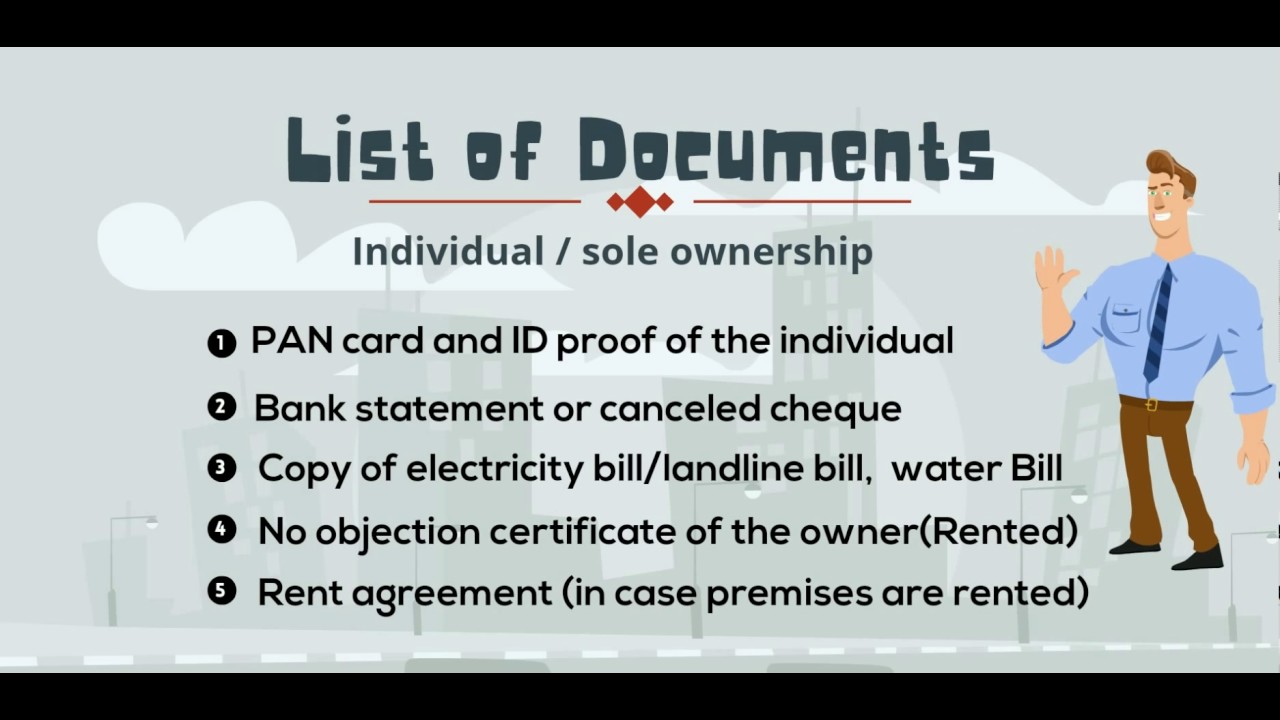

FOR PROPRIETORSHIP FIRM

Following documents of proprietor:

- PAN Card

- Aadhar Card

- Soft copy of Photograph

- List of Sale & Purchase Items

- Cancel Cheque

- Rent Agreement in case of rented property or NOC if owned by relatives

- Address Proof of Shop/Branch/Godown/Store: Anyone of the following (Should not be older than 2 months)

- Electricity bill

- Water tax

- Municipal Tax/House Tax BillDigital Signature Certificate (DSC) of at least one partner in case of LLP.

According to the section 122(1)(xi) of CGST Act, 2017 any taxable person who fails to register under GST even if he/she is legally bound as per the GST Act needs to pay the following amount of penalty:

- As per section 122(2)(a) for any reason, other than the reason of fraud or any wilful misstatement or suppression of facts to evade tax, shall be liable to a penalty of ten thousand rupees or ten per cent. of the tax due from such person, whichever is higher;.

- Otherwise as per section 122(2) (b) is 10,000 INR or amount of tax evaded whichever is higher.

GST Registration Charges:As previously stated, there is no cost associated with GST registration. Businesses must register for GST if their yearly revenue exceeds Rs. 20 lakh.

ReplyDelete